Grab is the ride hailing Unicorn that has had to solve problems others haven’t. They operate in markets where cash dominates, where traditional banking doesn’t serve the majority of the population and many of their drivers rely on them for a stable income stream.

Its answer is Grab Financial, with a vision to provide a whole suite of financial services inside its super app ecosystem, with the challenger offering at the core.

Not only would this potentially financially include tens of millions of people, it could improve their ability to manage periods of low income, or save for a rainy day.

11:FS’ experience and on the ground support has been valuable in helping us focus and create a product that works for both our users and our business. Their input to strategy, marketing, go-to-market, product launch and design work was first class, and exactly what we wanted from our first partnership with them.

11:FS’ experience and on the ground support has been valuable in helping us focus and create a product that works for both our users and our business. Their input to strategy, marketing, go-to-market, product launch and design work was first class, and exactly what we wanted from our first partnership with them.

11:FS’ experience and on the ground support has been valuable in helping us focus and create a product that works for both our users and our business. Their input to strategy, marketing, go-to-market, product launch and design work was first class, and exactly what we wanted from our first partnership with them.

11:FS’ experience and on the ground support has been valuable in helping us focus and create a product that works for both our users and our business. Their input to strategy, marketing, go-to-market, product launch and design work was first class, and exactly what we wanted from our first partnership with them.

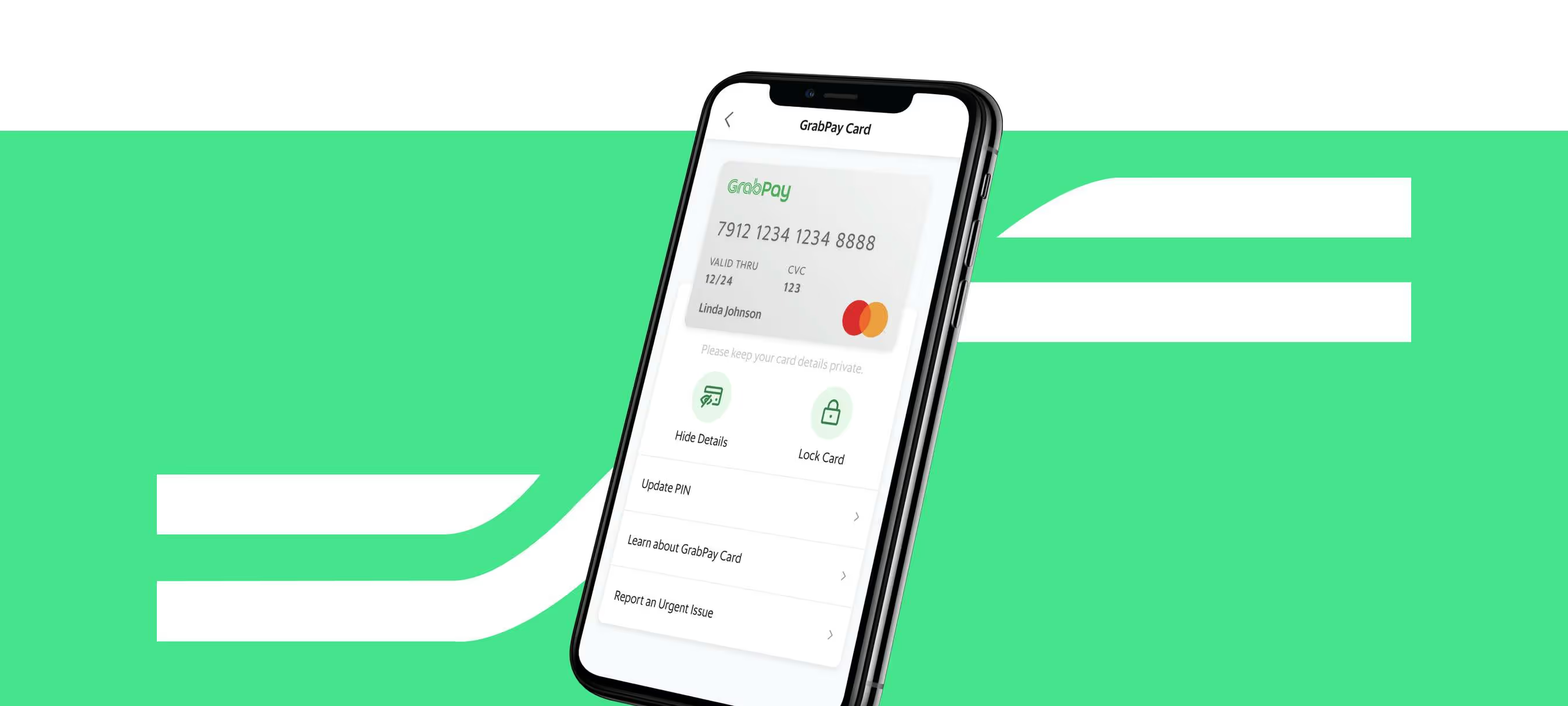

Grab Financial engaged with 11:FS to support the launch of its GrabPay Mastercard. The project had three core objectives:

Grab, of course, has plenty of talented people to execute and deliver, but when it came to researching and defining the scope of the service, it required in depth research and proposition design. Southeast Asia is not one place, it’s many. Singapore and the Philippines are dramatically different markets, but both were primary markets for the new GrabPay offering.

A card could help people use e-commerce for the first time in some markets, or in others it could make an FX transaction much simpler and transparent. Helping this all fit inside a super app, was a daunting challenge, that impacted everything from pricing, marketing, brand strategy and design.

Grab Financial engaged with 11:FS to support the launch of its GrabPay Mastercard. The project had three core objectives:

Grab, of course, has plenty of talented people to execute and deliver, but when it came to researching and defining the scope of the service, it required in depth research and proposition design. Southeast Asia is not one place, it’s many. Singapore and the Philippines are dramatically different markets, but both were primary markets for the new GrabPay offering.

A card could help people use e-commerce for the first time in some markets, or in others it could make an FX transaction much simpler and transparent. Helping this all fit inside a super app, was a daunting challenge, that impacted everything from pricing, marketing, brand strategy and design.

11:FS ran a comprehensive Discovery project, based out of Singapore, that covered the breadth of the offering. This began by reviewing Grab's go-to-market strategy and benchmarking the strategy and service against best in class offerings globally.

From this, the 11:FS team then identified gaps against Grab’s stated aim for GrabPay service to be the most comprehensive app for users. In collaboration with Grab’s teams, the launch strategy was re-focused, and the branding, pricing model and commercial strategy reworked.

Finally, 11:FS created a comprehensive library of design assets for customer acquisition and on-boarding of users onto GrabPay.