A US retail bank has engaged with 11:FS to create a world class, differentiated digital banking proposition for the US. In a market that includes Tier 1 banks, supra-regional banks as well as regional banks, community banks and credit unions, as well as new challenger banks, it wanted to create a proposition that would stand out.

For many Americans, real time, contextual mobile banking doesn’t exist. One reason is that the barriers for new firms to enter the market are high.

11:FS and the bank are looking to change that and use the rapidly shifting market dynamics and evolving customer expectations to create a new digital bank that solves key customer pain points including frictionless instant payments, instant transfers.

The project began with a Discovery phase. This included using Jobs to be Done as a framework to assess the retail banking market and identify undermet and underserved needs.

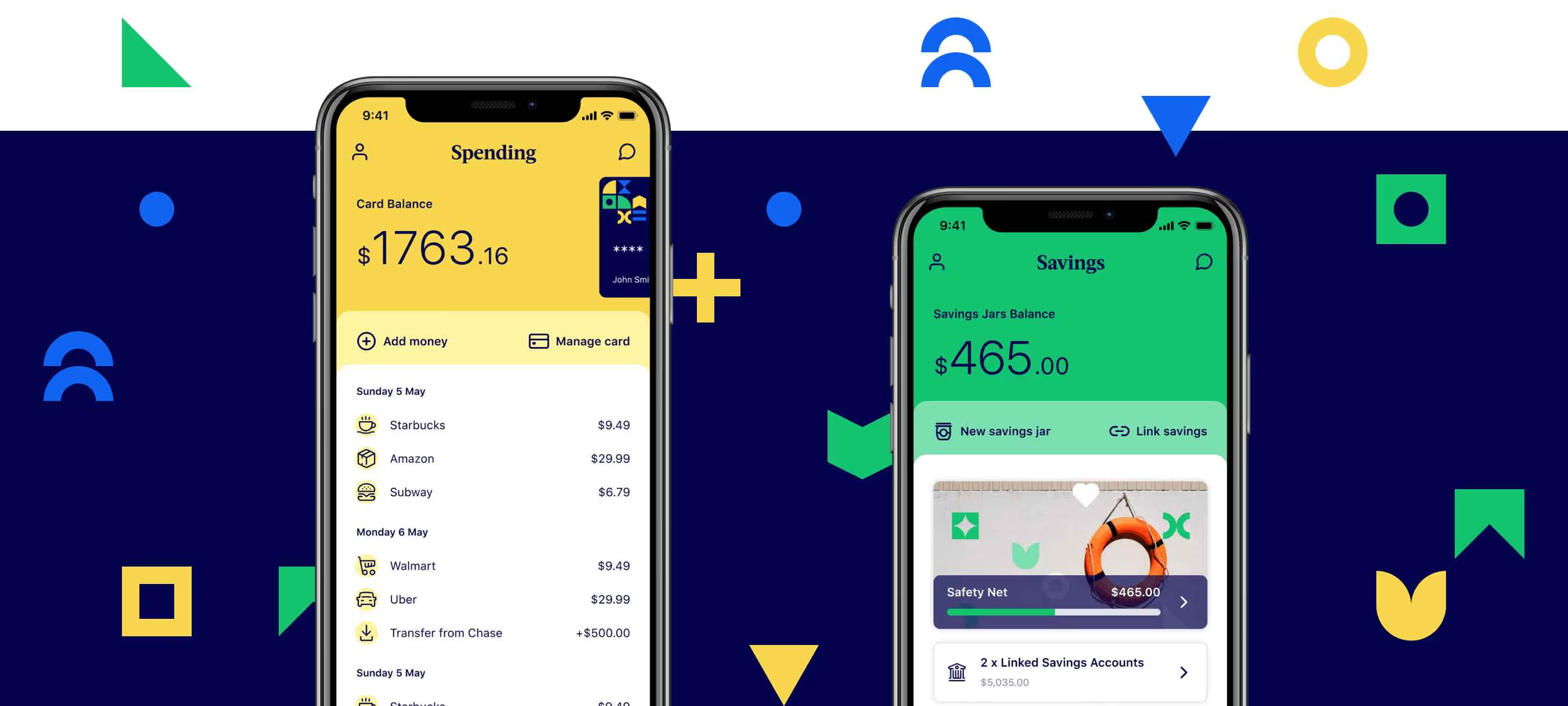

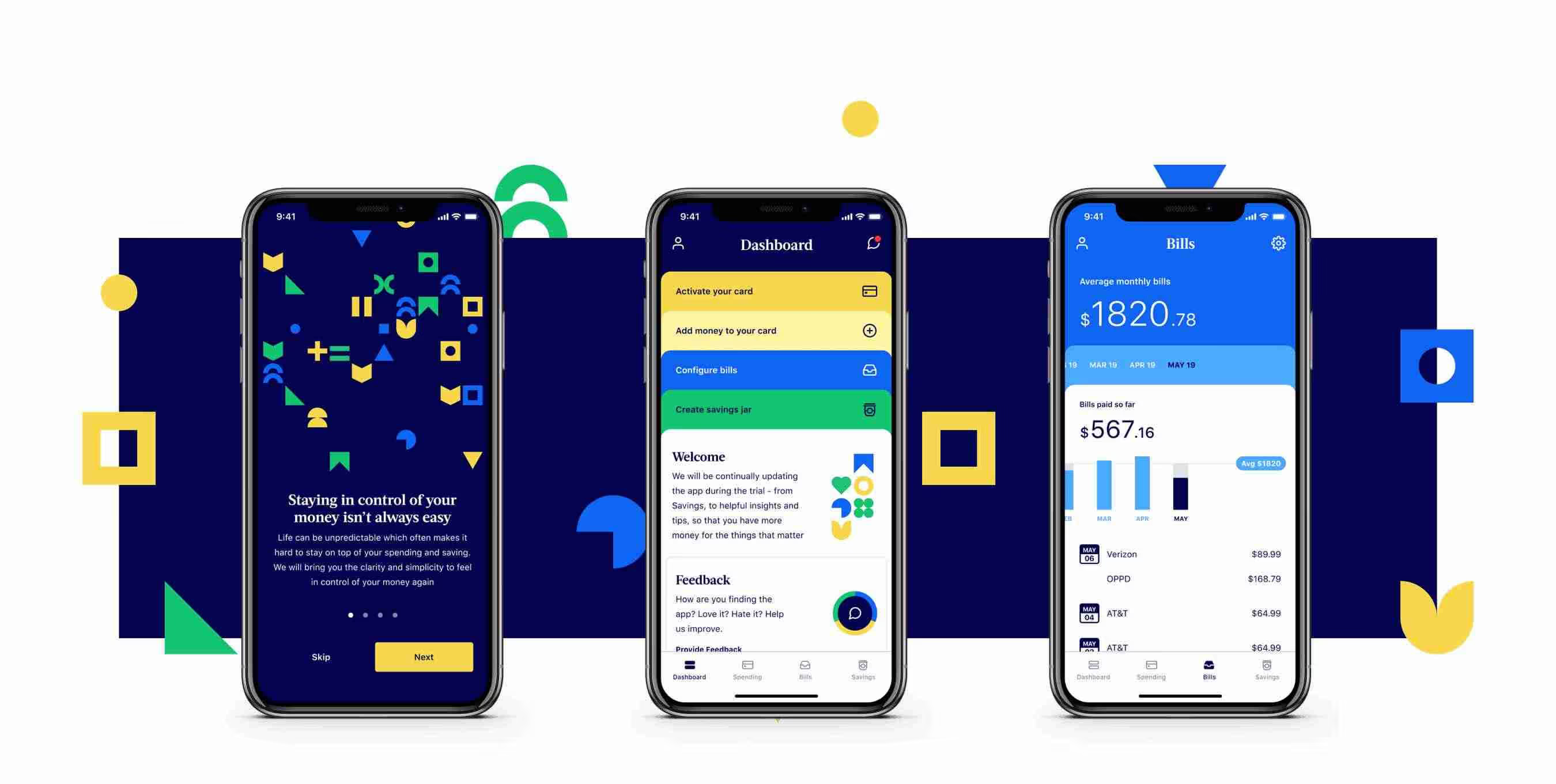

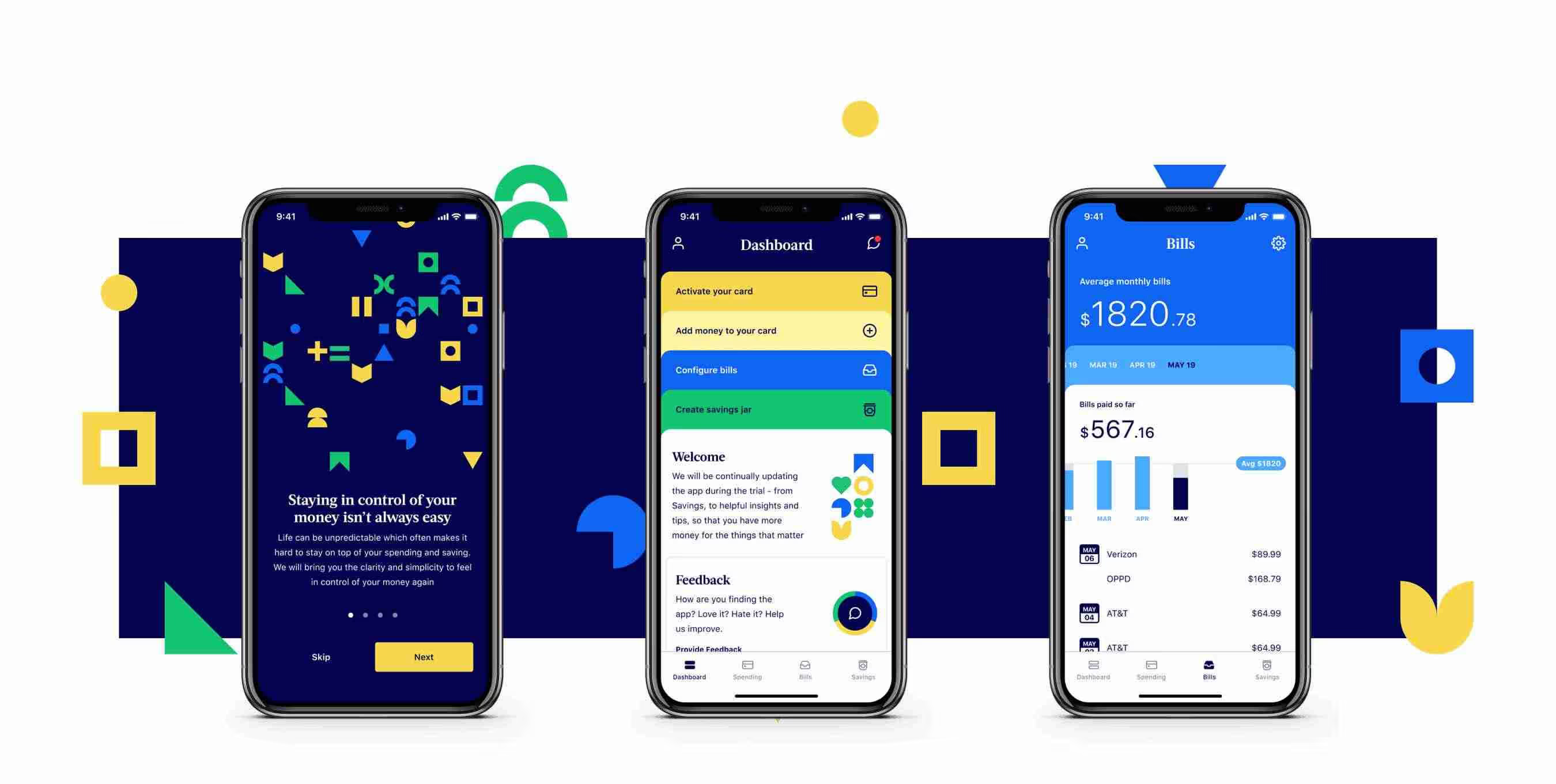

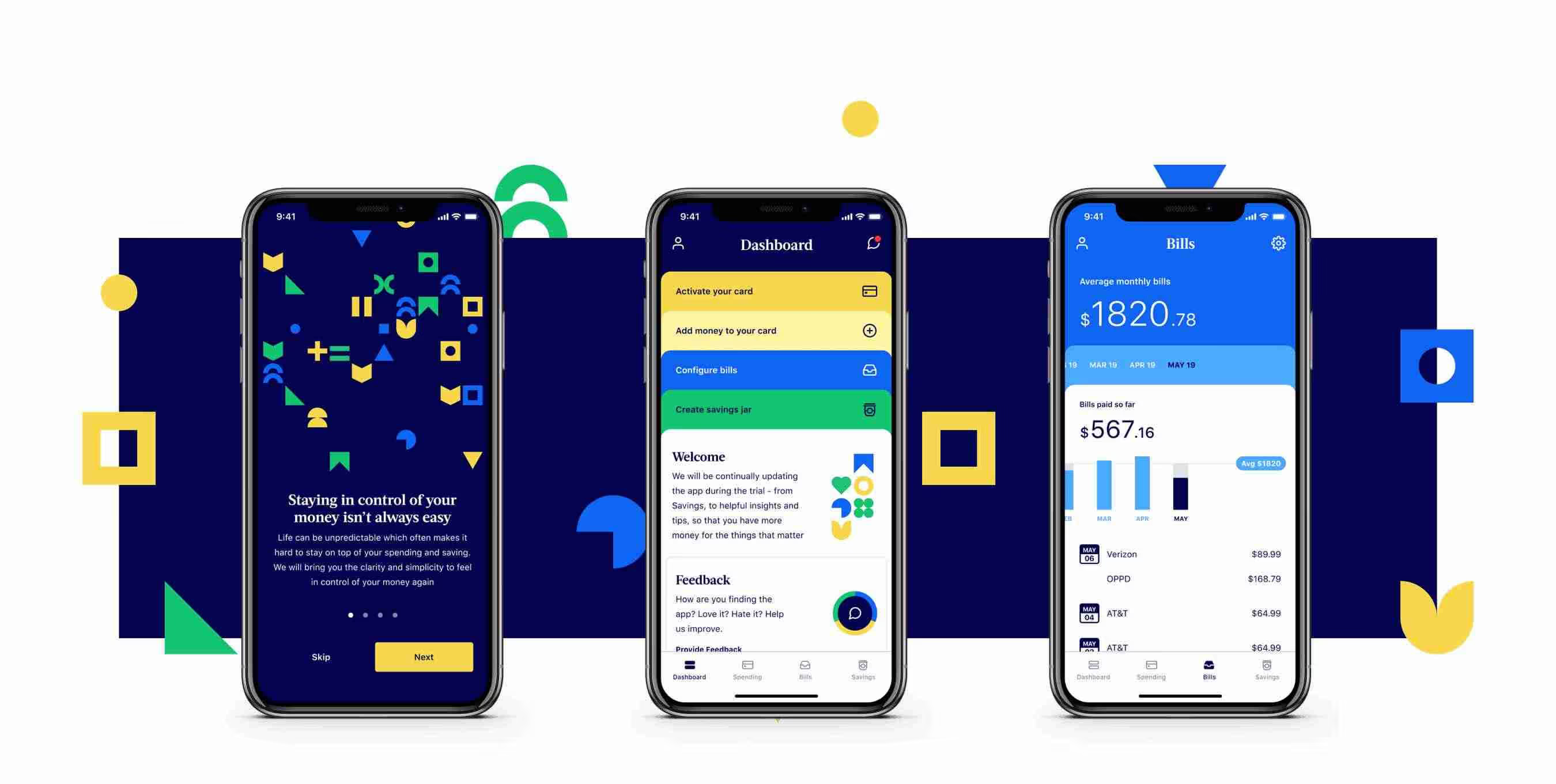

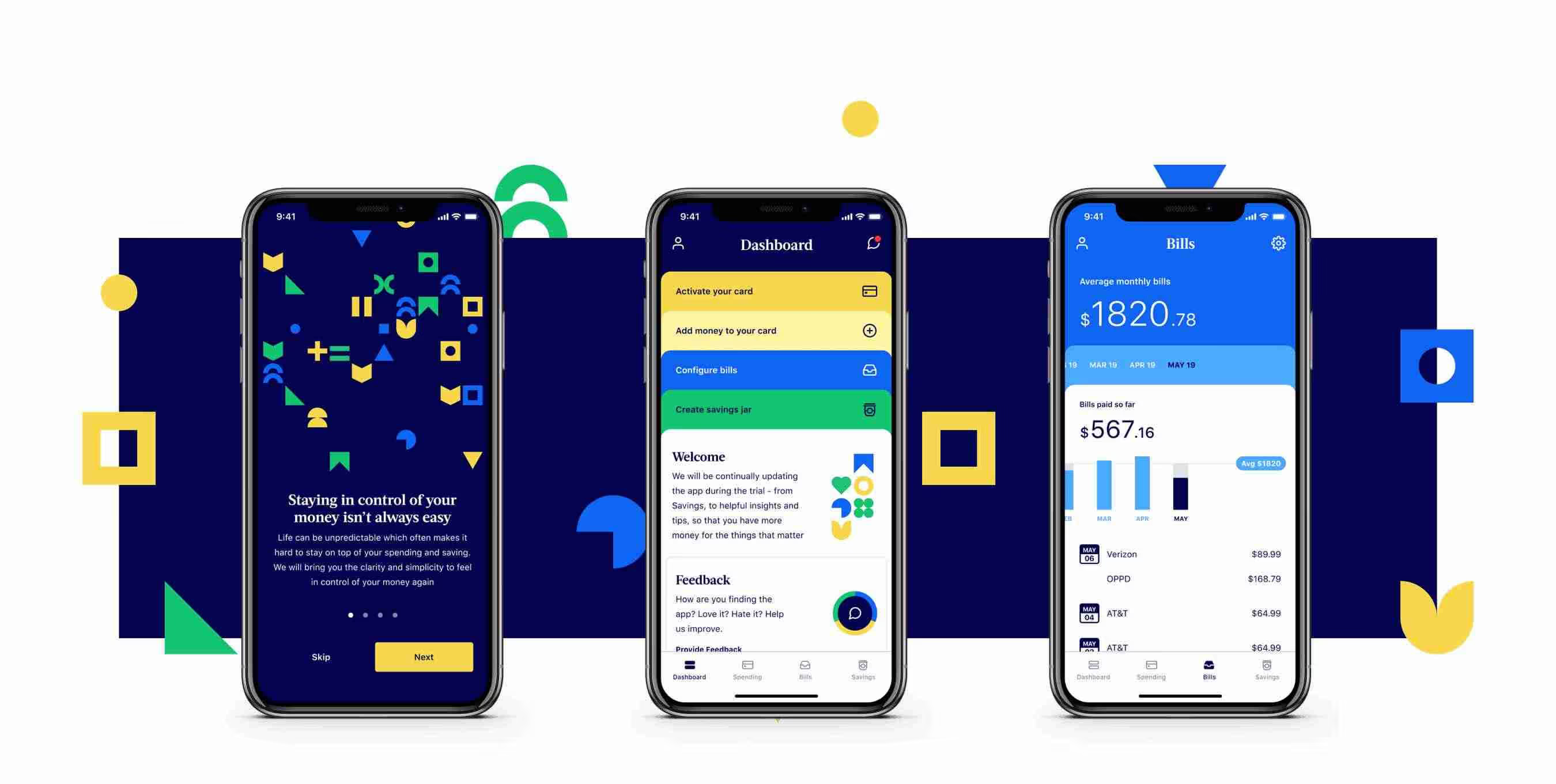

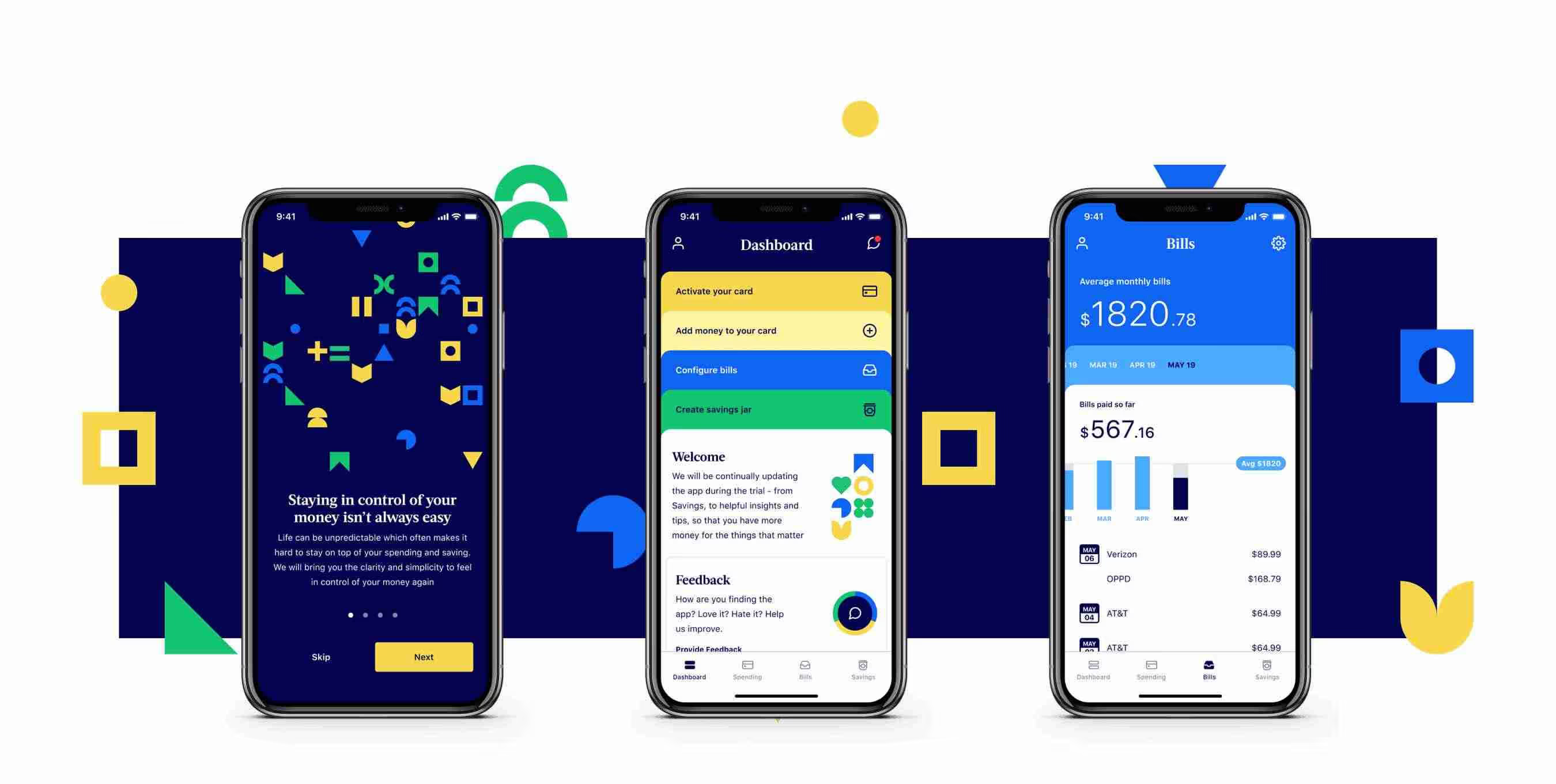

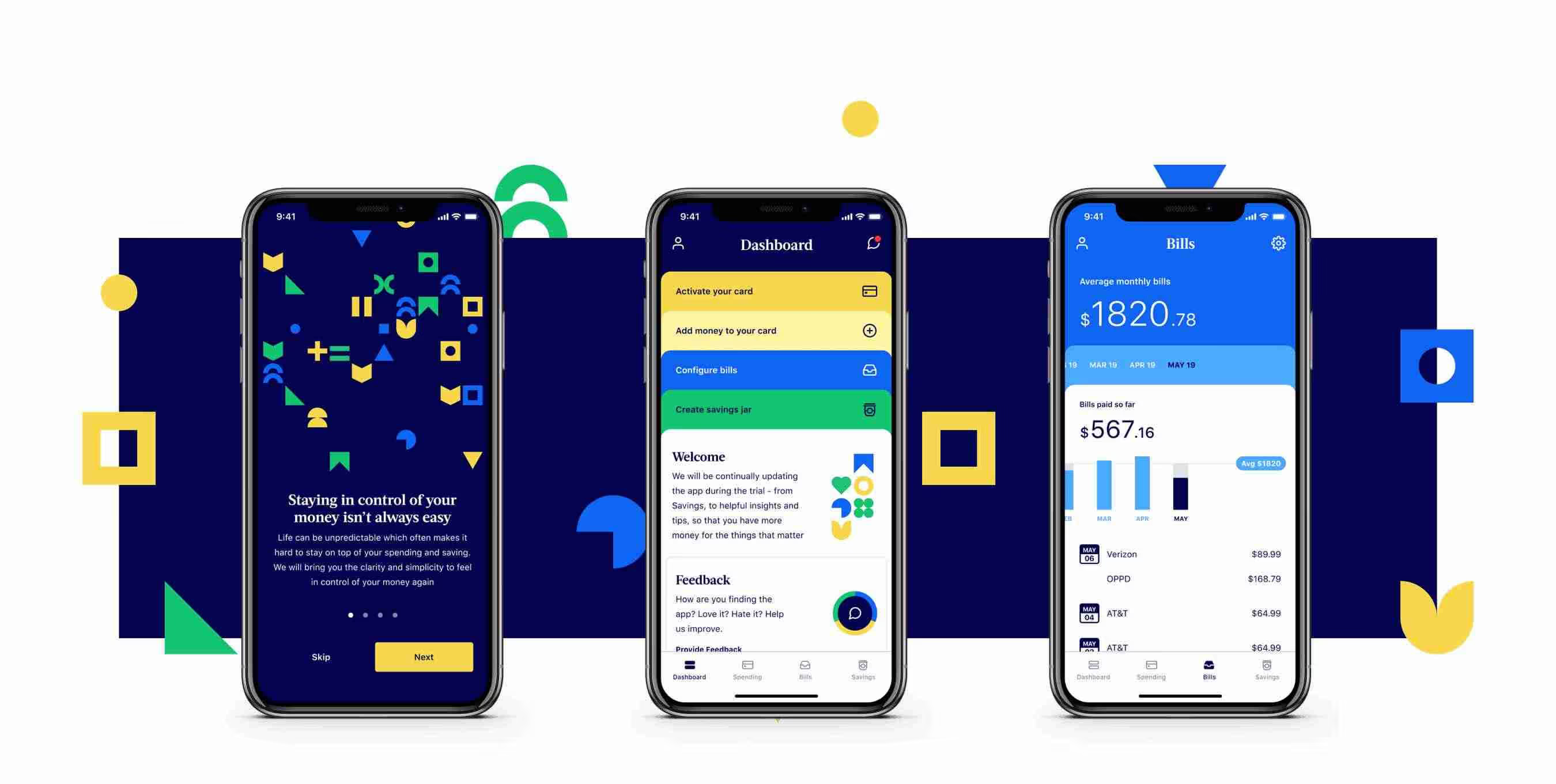

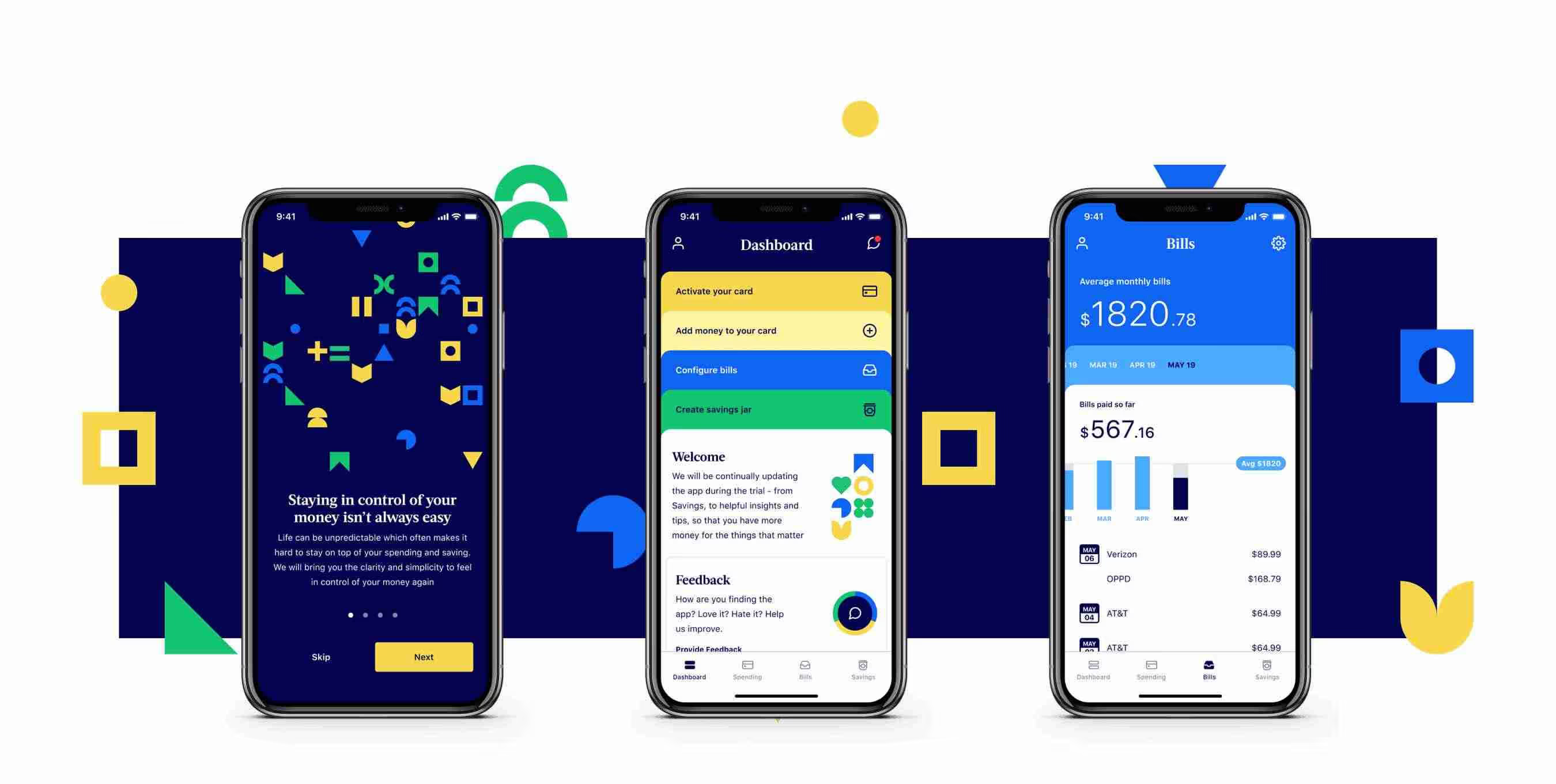

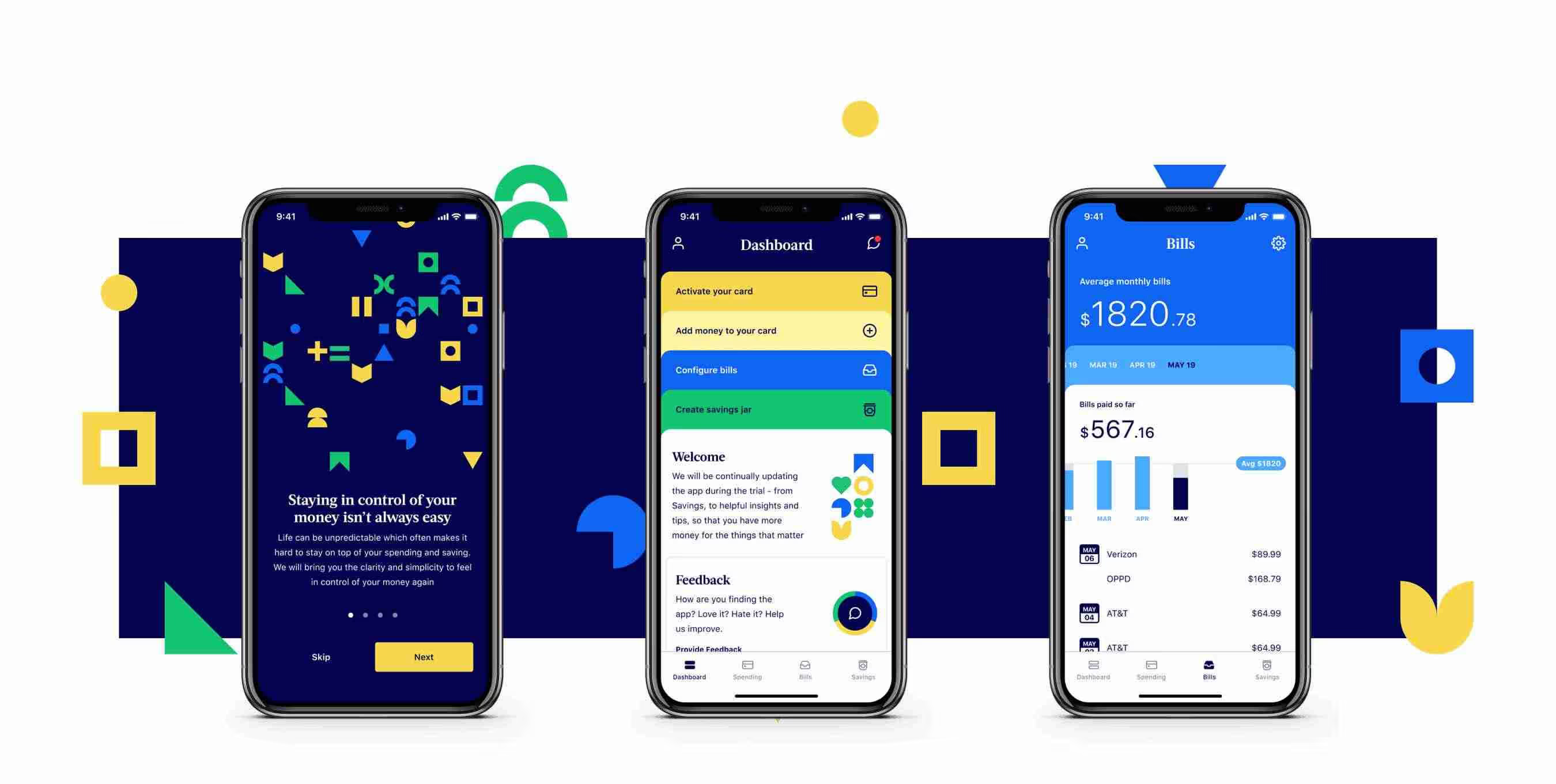

The 11:FS team then focussed on defining a prototype and then rapidly iterated against those initial ideas, creating a minimal loveable product (MLP). That pre-Alpha utilised 11:FS’ engineering talent, delivery know how and design expertise as it scaled the product that moved from inception to working prototype in a matter of months.

For many Americans, real time, contextual mobile banking doesn’t exist. One reason is that the barriers for new firms to enter the market are high.

11:FS and the bank are looking to change that and use the rapidly shifting market dynamics and evolving customer expectations to create a new digital bank that solves key customer pain points including frictionless instant payments, instant transfers.

The project began with a Discovery phase. This included using Jobs to be Done as a framework to assess the retail banking market and identify undermet and underserved needs.

The 11:FS team then focussed on defining a prototype and then rapidly iterated against those initial ideas, creating a minimal loveable product (MLP). That pre-Alpha utilised 11:FS’ engineering talent, delivery know how and design expertise as it scaled the product that moved from inception to working prototype in a matter of months.

After demonstrating significant success through the first 12 weeks of the project, subsequent phases have focussed on building the bank and getting it into the hands of early adopters.

In under six months, the digital bank has gone from concept to working prototype and is now in Alpha with customers. They are using the service and feeding back on their experiences. This is critical to ensuring the proposition is iterated along the Jobs identified during the Discovery phase that will allow the proposition to stand out in a highly competitive market.

The app-based account is delivering against the vision of creating a bank that offers meaningful insights into individuals’ finances, with real-time alerts providing ‘on-the-go’ visibility to their accounts.